Paul Krugman is mainly known in the States as an economist who writes frequently for The New York Times. Meanwhile, few really know much about his serious academic work. Now that’s he’s been awarded the Nobel Prize, it’s worth giving you a quick feel for it. Here’s Krugman giving you the gist in his own words (iTunes — Rss Feed — Stream).

A Brief History of the 1929 Crash

With the gyrations of the world markets, 1929 was suddenly very present last week. All too present. What really went down in ’29? Below we present “The Crash of 1929,” a documentary that aired as part of PBS’ The American Experience Series. Part 1 appears below. You can get the remaining parts here: Part 2, Part 3, Part 4 and Part 5.

Related Content

Free Presidential Biographies on iTunes: FDR and Beyond

The 2nd Presidential Debate in Ten Easy Minutes

In case you missed it, here’s a paired down version of last night’s second presidential debate in all of its uninspiring glory:

Joseph Stiglitz on Managing the Global Credit Crunch

As part of our effort to provide insight into the ongoing credit crisis, we present a talk just given at Oxford University by the Nobel Prize winning economist, Joseph Stiglitz (iTunes — Rss Feed). The author of Globalization and its Discontents uses the talk as an opportunity to outline the events that contributed to the global credit crisis, and the future regulations that could get us back on track. The talk runs a good hour, and it takes about 20–25 minutes for Stiglitz to really focus on the credit crunch, and about 45 minutes before he starts discussing tangible solutions. Don’t expect any magic bullets, any short term solutions that will get the current crisis under control. It’s more pragmatic long-term solutions that you’ll find here.

Related Content:

The Financial Crisis Explained

Ten Days That Shook The Financial World

This American Life Demystifies The Credit Crisis

Tina Fey Does Sarah Palin Round #3

The Global Challenges Facing The Next U.S. President

CNN recently hosted a conversation with several recent Secretaries of State, and they all discussed the major challenges that Barack Obama or John McCain will be facing next year. This is no ordinary time, and it’s rare to find Henry Kissinger, Madeleine Albright, Warren Christopher, Colin Powell, and James Baker all sitting on the same stage and offering their advice. Below, we have posted the first segment. You can watch the remaining parts here.

China’s Space Walk: Fresh Footage

As US stock declines, China’s stock keeps going up. It’s the story of the decade, really. Here’s footage from China’s first space walk this past week …

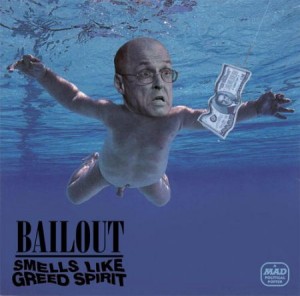

MAD Parodies the Bailout: “Smells Like Greed Spirit”

Straight from BoingBoing: The new MAD Magazine artwork below. Glad someone can find a little humor in this…

(PS Also see BoingBoing’s piece on the changing WaMu web site.)